Consent Form for Electronic Delivery

Please fill out the Consent form completely. This information is used to verify who you are and to get you the information that you need correctly and quickly. Incomplete forms will delay the delivery of your requested documents. We do NOT send documents to 3rd parties.

Please note that Consent forms may take 5-7 business days to be processed, especially during tax season. We appreciate your understanding.

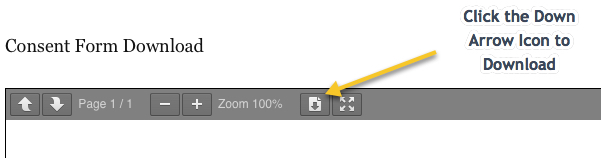

Consent Form Download